|

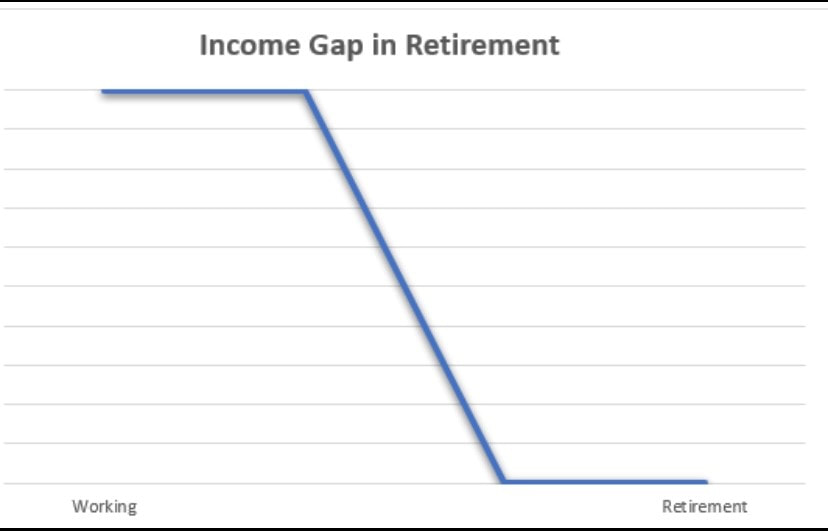

The purpose of a pension plan is to help you reduce the income gap experienced when you retire by building up a pot that you can take an extra income from in addition to receiving the State Pension.

The average weekly earnings for employees in Ireland is €812, with the maximum State Pension provided being €248.30 per week*. That is an average drop in income of €564 per week. So, to enable you to be able to fully retire or at least cut back on your working life you will need funds in place to assist you during retirement. As an incentive to help people be prepared for Retirement the money you invest in your pension grows tax free. So, like certain savings and investments there is no deemed tax deducted throughout the course of your pension and the value of your pension cannot be considered for tax deduction purposes. What is also very appealing to investing in a pension is the Tax Relief on all contributions paid.** With this if you were to take €1,000 as an income into your pocket The Revenue gets €400 of this (for persons on the higher tax bracket) leaving you with €600. However, if you were to invest that €1,000 into your pension with the tax relief incentive you will save €400 from the Revenue as the full €1,000 will be invested in your pension. It is important to have a pension plan in place and to review your existing plan to ensure that you are on the right track to supporting the lifestyle you are aiming for when you are no longer working! We are here to assist you with this so do not hesitate in giving us a call. *This is the maximum State Pension Contributory amount provided and is subject to your PRSI contributions or a means test if applicable for the Non-Contributory State Pension. **Income Tax Relief up to a limit each year related to age and net relevant earnings in that tax year. (With October just upon us, we will address the tax relief limits as the tax deadlines 31 October/17 November are approaching!)

0 Comments

As it is the time now that children are starting and returning back to college a lot of families are met again with the financial strain caused by the cost of educating their children. Further to this some families have resorted to taking out a loan to help pay these fees.

For students in college who are living away from home during their time in college the average annual cost ranges from €12,109 - €14,553, with the current average amount in savings being €7,049*. A regular Savings Plan helps in ensuring that you can provide for your children’s education right through to third level. By planning ahead and putting an amount aside every month you will be in a much better position when comes the time to send your children to school/college. We have attached below a calculator which gives you an estimate of the amount to set aside each month and to even start with a smaller amount than suggested will be of great benefit to you. Saving with us will give you a wide range of options and fund choices and will assess your financial situation to ensure you are invested in a plan best suited to your needs. For further information on our savings and investment products just give us a ring or call in to our office. *Zurich Life Cost of Education Survey 2021 It’s that time of year again when the tax deadline looms. 31st October is the deadline for paper-based returns and 17th November for online returns to be made for self-assessed income tax for the 2020 tax year. Pension contributions are a big feature of these returns for many people, and this is one reason to review your pension today.

The tax benefits of pensions are extremely valuable Pension contributions are one of the few remaining means of gaining marginal rate tax relief today. If you are in a position to make additional pension contributions, do this before the tax deadline and you can gain tax relief against your 2020 income. This would be one good use of the increased savings you put away during the pandemic! Give us a call and we can guide you as to any contribution limits that would apply to you. Relying on the state won’t get you far in retirement In Ireland, the state provides an old age pension to qualifying people. The maximum level of this pension is €248.30 per week for a single person – this is hardly going to deliver a lifestyle of luxury. Even at this, the state pension scheme is under extreme pressure. The ratio of people working compared to retired people will reduce from 5 to 1 today, to 2 working to 1 retired by 2050. There will be fewer people paying in and more seeking payment from the system*. The plan was to address this by pushing out the state retirement age, but this was not implemented after becoming an election issue. With the challenges facing the state pension scheme, there is really only one likely outcome – the level of state benefits are very unlikely to increase. We all need to take control of our own pension planning, and the time to do so is right now. Now is the time to take control The longer you pay into your pension scheme, the more you can hope to receive when you retire, as you let increased contributions, time and compound interest get to work. We’re often asked how much you should pay in to your pension scheme. If possible, you should look to maximise the tax relief opportunities, but otherwise a very rough rule of thumb is that you should aim to save “half your age”. So for example if you are 40 years old, you should aim to save 20% of your income each year from now until retirement to build up a decent fund. If you wait until you are aged 50 to start, you should then aim to save 25% of your income each year. But this is only a very rough calculation. A full review of your pension circumstances will enable us to develop a far more tailored picture for you, taking account of any existing benefits that you have already built up. Life expectancy is increasing Savings in retirement will need to last on average for at least 20 years in retirement for female clients who are aged 66, and 17 years for males when they retire. Because of medical science and better diets etc., these periods are expected to increase. Indeed it is reckoned that the first person to live to be 150 years of age has already been born! While that is unlikely to be you, more and more people will now be retired for 30 - 35 years. What size of pension fund would you need to maintain your lifestyle for that period? This is another reason for a pension review now Right now is the time to review your pension. Give us a call, we’ll be delighted to help. *Sources: Irish Life, revenue.ie, gov.ie - National Risk Assessment 2019 & Health in Ireland Key Trends 2019 (JMS LIFE) |

John CumminsWrite something about yourself. No need to be fancy, just an overview. Categories

All

Archives

March 2023

|

Location |

|

Cummins Insurances Ltd. T/A Cummins Financial Services is regulated by the Central Bank of Ireland

Privacy Policy was last updated on Tue May 26 2020.

Commission summary document

Privacy Policy was last updated on Tue May 26 2020.

Commission summary document

RSS Feed

RSS Feed