|

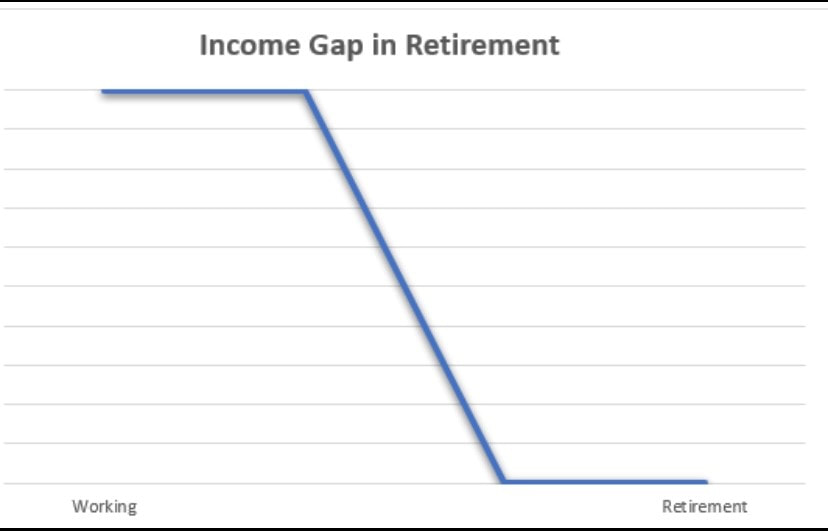

The purpose of a pension plan is to help you reduce the income gap experienced when you retire by building up a pot that you can take an extra income from in addition to receiving the State Pension.

The average weekly earnings for employees in Ireland is €812, with the maximum State Pension provided being €248.30 per week*. That is an average drop in income of €564 per week. So, to enable you to be able to fully retire or at least cut back on your working life you will need funds in place to assist you during retirement. As an incentive to help people be prepared for Retirement the money you invest in your pension grows tax free. So, like certain savings and investments there is no deemed tax deducted throughout the course of your pension and the value of your pension cannot be considered for tax deduction purposes. What is also very appealing to investing in a pension is the Tax Relief on all contributions paid.** With this if you were to take €1,000 as an income into your pocket The Revenue gets €400 of this (for persons on the higher tax bracket) leaving you with €600. However, if you were to invest that €1,000 into your pension with the tax relief incentive you will save €400 from the Revenue as the full €1,000 will be invested in your pension. It is important to have a pension plan in place and to review your existing plan to ensure that you are on the right track to supporting the lifestyle you are aiming for when you are no longer working! We are here to assist you with this so do not hesitate in giving us a call. *This is the maximum State Pension Contributory amount provided and is subject to your PRSI contributions or a means test if applicable for the Non-Contributory State Pension. **Income Tax Relief up to a limit each year related to age and net relevant earnings in that tax year. (With October just upon us, we will address the tax relief limits as the tax deadlines 31 October/17 November are approaching!)

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

John CumminsWrite something about yourself. No need to be fancy, just an overview. Categories

All

Archives

March 2023

|

Location |

|

Cummins Insurances Ltd. T/A Cummins Financial Services is regulated by the Central Bank of Ireland

Privacy Policy was last updated on Tue May 26 2020.

Commission summary document

Privacy Policy was last updated on Tue May 26 2020.

Commission summary document

RSS Feed

RSS Feed