|

Tax Relief on Contributions

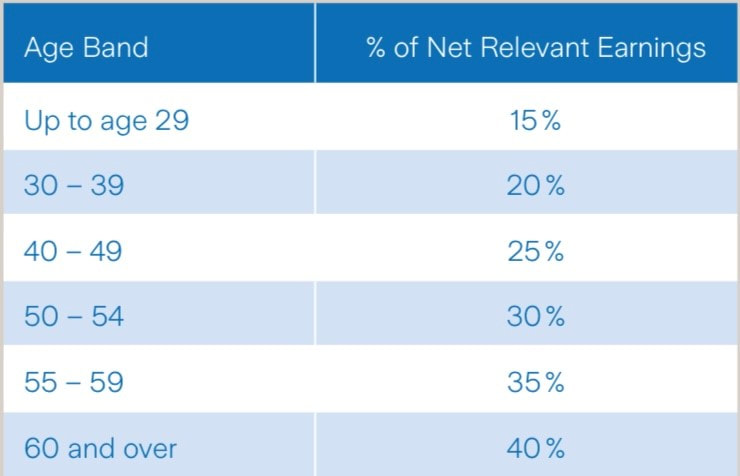

One of the most compelling reasons to invest in a pension is the generous tax relief on contributions. When you contribute to a pension scheme, you receive tax relief at your marginal rate. This means that for every €100 you contribute, it may only cost you €80 or even less, depending on your income tax rate. This immediate tax benefit can substantially reduce your overall tax bill. The money you invest in a pension grows tax-free. This means that any returns on your investments within the pension fund are not subject to income tax, capital gains tax, or dividend tax. Over time, this tax-free growth can significantly boost your retirement savings. This can be achieved by personally making a lump sum Personal Pension, PRSA or PRSA AVC contribution by 31 October 2023 (or 15 November 2023 for ROS users) and electing to backdate the tax relief to 2022. Contact us for assistance in making your contribution.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

John CumminsWrite something about yourself. No need to be fancy, just an overview. Categories

All

Archives

March 2023

|

Location |

|

Cummins Insurances Ltd. T/A Cummins Financial Services is regulated by the Central Bank of Ireland

Privacy Policy was last updated on Tue May 26 2020.

Commission summary document

Privacy Policy was last updated on Tue May 26 2020.

Commission summary document

RSS Feed

RSS Feed