|

It's that time of the year again - the Tax Deadline approaches. The dates to know are the 31st October the deadline for paper-based returns and 17th November for online returns to be made for self-assessed income tax for the 2020 tax year.

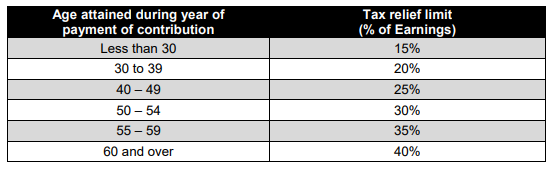

During this period before completing your file and pay you are given the opportunity to maximise the tax relief available to you by maximising your pension contributions. There are limits based on age as to what percentage of your earnings can be used for tax relief, which are displayed in the above picture. Please note that the maximum earnings which can count for income tax relief on total personal contributions into any pension arrangement in a year is €115,000. If you wish to discuss the options available to you regarding your existing pensions and the additional contributions you can make please contact us.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

John CumminsWrite something about yourself. No need to be fancy, just an overview. Categories

All

Archives

March 2023

|

Location |

|

Cummins Insurances Ltd. T/A Cummins Financial Services is regulated by the Central Bank of Ireland

Privacy Policy was last updated on Tue May 26 2020.

Commission summary document

Privacy Policy was last updated on Tue May 26 2020.

Commission summary document

RSS Feed

RSS Feed